No.1 Bitcoin’s Price Journey: From Humble Beginnings to Moon Missions (and Back)

Remember 2009? Back when flip phones were peak tech and nobody knew what “normie” meant? That’s also the year a mysterious dude named Satoshi Nakamoto unleashed a digital revolution: Bitcoin. But unlike fidget spinners, Bitcoin’s journey has been anything but a fad. Let’s blast off on a trip through Bitcoin’s price history, from its basement-dweller beginnings to its status as the OG crypto king.

The Genesis Block: Pennies on the Street

Bitcoin started out about as valuable as a participation trophy. In 2010, you could snag a whole BTC for a measly ten cents. That’s like finding a hundred-dollar bill on the sidewalk – except way cooler, because cryptography.

Pizza Time! The First Real-World Transaction

May 22nd, 2010, marked a legendary moment. Laszlo Hanyecz, a true crypto OG, immortalized himself by buying two Papa John’s pizzas for a whopping 10,000 BTC. Ouch! In today’s market, that would be a cool $400 million pizza order (although, hopefully with better toppings). This event showed the potential of Bitcoin as a real currency, not just some internet magic trick.

The Rollercoaster Begins: Boom and Bust Cycles

If you thought the price action on your favorite memecoin was crazy, buckle up for Bitcoin’s wild ride. Early adopters saw massive gains as Bitcoin climbed to over $1,000 in 2013. Then came the first major crash, reminding everyone that crypto is a volatile beast. This boom-and-bust cycle has become a hallmark of BTC, with prices soaring to new highs followed by sometimes brutal corrections.

Halving Hype: A Built-in Price Booster?

One of the factors influencing Bitcoin’s price is something called “halving.” Every four years, the number of new BTC generated gets cut in half. This scarcity creates a supply and demand situation, theoretically driving the price up. Think of it like your favorite limited-edition sneakers – less available, more hype, potentially higher resale value.

The Rise of Institutional Investors: From Memes to Money Managers

BTC used to be seen as a fringe asset for tech bros in their mom’s basements. But that’s all changed. Today, major financial institutions are getting on board, bringing a wave of legitimacy and, more importantly, cash flow. This institutional money has helped push BTC’s price to new heights.

From Dark Web to Wall Street

BTC’s journey from an obscure digital token to a legitimate financial asset is nothing short of extraordinary. Initially, it was popular on the dark web, used for transactions that preferred anonymity. However, as time went on, its value and potential caught the eye of Wall Street investors, bringing a new level of credibility and stability.

2017: The Year Bitcoin Went Mainstream

The year 2017 was a pivotal point for BTC. It began the year at around $1,000 and skyrocketed to nearly $20,000 by December. This meteoric rise brought BTC into the mainstream consciousness. Everyone from tech enthusiasts to your grandma was talking about BTC, and media outlets couldn’t get enough of it.

The Crypto Winter

After reaching its peak in 2017, BTC faced a harsh reality check. The subsequent crash, often referred to as the “crypto winter,” saw its value plummet by over 80%. Many skeptics saw this as the end of Bitcoin, but true believers held on, convinced that this was just another phase in its volatile journey.

Bitcoin’s Resurgence: 2020 and Beyond

The COVID-19 pandemic had a profound impact on global economies, and Bitcoin was no exception. Amidst the economic uncertainty, Bitcoin emerged as a “digital gold,” a hedge against inflation and economic instability. By the end of 2020, Bitcoin had once again surged past its previous all-time high, reaching over $30,000.

know more : Investing News Network

The Influence of Social Media and Celebrities

Social media platforms and high-profile endorsements have played a significant role in Bitcoin’s price movements. Tweets from influential personalities like Elon Musk can cause dramatic fluctuations in Bitcoin’s value. This phenomenon underscores the power of social media in shaping financial markets.

Regulatory Challenges and Adoption

Bitcoin’s rise has not been without challenges. Regulatory scrutiny has increased as governments around the world grapple with how to handle this new form of currency. Despite these hurdles, adoption continues to grow, with more businesses accepting Bitcoin and countries like El Salvador recognizing it as legal tender.

The Environmental Debate

BTC mining, the process by which new bitcoins are created, requires significant computational power and energy. This has led to a heated debate about its environmental impact. Proponents argue that renewable energy sources can mitigate this issue, while critics point to the carbon footprint of large mining operations.

The Future of Bitcoin: Predictions and Speculations

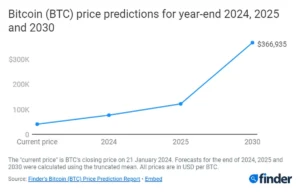

Predicting BTC’s future is like reading tea leaves – everyone has a theory, but no one knows for sure. Some experts believe BTC could reach $100,000 or even $1 million per BTC , while others caution that regulatory pressures and market volatility could lead to a more subdued growth trajectory.

Bitcoin and the Concept of Digital Gold

One of the most compelling narratives around Bitcoin is its comparison to gold. Like gold, BTC is seen as a store of value and a hedge against inflation. This analogy has helped it gain acceptance among traditional investors looking for alternative assets to diversify their portfolios.

know more : Analyticsinsight

The Role of Bitcoin in Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is an emerging sector that aims to recreate traditional financial systems in a decentralized manner using blockchain technology. BTC plays a crucial role in this ecosystem, providing liquidity and serving as collateral for various DeFi applications.

Hod Ling: The Strategy of Long-Term Holding

HODLing, a term derived from a misspelled forum post in 2013, has become a mantra for BTC enthusiasts. It refers to the strategy of holding onto BTCfor the long term, regardless of market fluctuations. This approach has paid off handsomely for early adopters who have weathered multiple market cycles.

The Impact of Global Events on BTC’S Price

Global events, from economic crises to geopolitical tensions, can have a significant impact on Bitcoin’s price. For instance, during times of economic instability, Bitcoin often sees increased interest as a safe-haven asset. Understanding these dynamics is crucial for anyone looking to navigate the Bitcoin market.

Conclusion: The Ever-Evolving Journey of BTC

Bitcoin’s journey from a niche digital currency to a global financial phenomenon has been nothing short of extraordinary. Its price history is a testament to the excitement, volatility, and transformative potential of this revolutionary technology. From its inception in 2009, when the mysterious Satoshi Nakamoto introduced Bitcoin with the release of its whitepaper, the cryptocurrency has sparked debates and discussions across various spheres, whether it’s seen as the future of money, a digital gold, or a speculative asset. The first notable milestone came in 2010 when programmer Laszlo Hanyecz famously paid 10,000 BTC for two pizzas, highlighting BTC ‘s initial use case and its then-minuscule value. The subsequent years saw Bitcoin breaking the $1,000 barrier for the first time in 2013, a surge fueled by growing public interest and media coverage. However, this excitement was tempered by significant challenges, including the Mt. Gox hack in 2014, which led to the loss of approximately 850,000 BTC and caused a major price collapse. Despite these setbacks, Bitcoin began to recover in 2016, bolstered by increasing institutional interest and advancements in blockchain technology. The dramatic bull run of late 2017, which saw Bitcoin’s price skyrocket to nearly $20,000, was driven by factors such as growing public awareness, speculative investment, and the advent of initial coin offerings (ICOs). The subsequent correction in 2018 brought prices down to around $3,000, but the years following saw a maturation of the Bitcoin market. Institutional investors began to view Bitcoin as a hedge against inflation and economic uncertainty, with major companies like Tesla, Square, and Micro Strategy making significant investments in the cryptocurrency. This institutional interest has helped stabilize BTC ‘s price and further legitimize its status as a viable asset class. As we look toward the future, one thing is certain: BTC story is far from over. With each passing day, new developments, innovations, and challenges emerge, ensuring that the narrative of Bitcoin continues to evolve. So, buckle up and enjoy the ride—the next chapter in Bitcoin’s adventure is just around the corner, promising more twists, turns, and groundbreaking moments.

FAQs

1. What is BTC’S highest price ever recorded?

BTC’s highest price ever recorded was in November 2021, when it reached nearly $69,000 per BTC.

2. Why is BTC’S price so volatile?

BTC’s price is volatile due to a combination of factors including market speculation, regulatory news, macroeconomic trends, and its relatively low liquidity compared to traditional assets.

3. What is BTC halving, and why does it matter?

Bitcoin halving is an event that occurs approximately every four years, reducing the reward for mining new blocks by half. This decreases the rate at which new Bitcoins are created, contributing to its scarcity and potentially driving up its price.

4. How can I buy BTC?

You can buy BTC on various cryptocurrency exchanges like Coinbase, Binance, and Kraken. You need to create an account, verify your identity, and then you can purchase BTC using fiat currency or other cryptocurrencies.

5. Is BTC a good investment?

BTC’s investment potential depends on your financial goals and risk tolerance. While it has delivered significant returns for early investors, it is also highly volatile and carries risk. It’s important to do thorough research and consider speaking with a financial advisor before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Bittensor

Bittensor  Uniswap

Uniswap  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Internet Computer

Internet Computer

Thanks you so much for the feedback , Visit our other Websites too , you find it more valuable blogs like this —

1. https://bit2blogs.com/

2. https://myselfcrypto.com/

3. https://cryptocosmosworld.com/

4. https://cyptoscooptech.com/